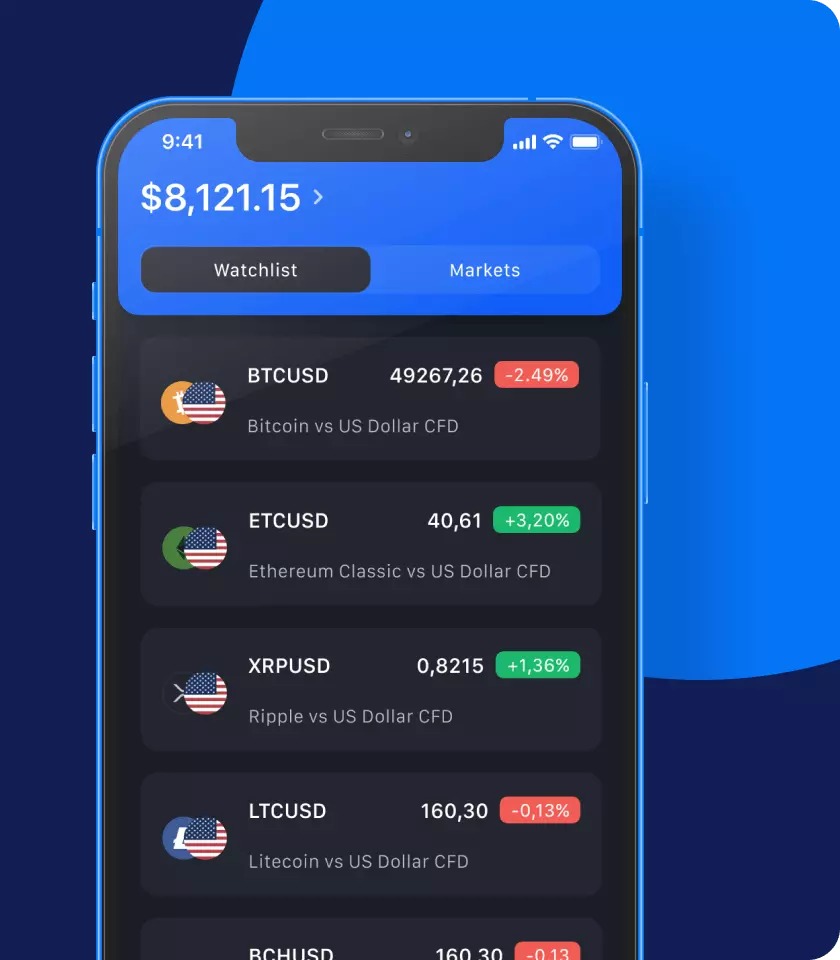

Start Trading Cryptocurrency CFDs

Become a part of a new trading experience: Buy & Sell Crypto CFDs with an Admirals trading account.

Seize opportunities in the volatile crypto markets 24/7 by adding crypto CFDs to your portfolio!

Trading CFDs is risky. You might lose all your invested capital.

Your Crypto Trading Experience Starts Now

Wide Range

Trade CFDs on over 20 popular cryptocurrencies

Long or Short

Go long or short on top cryptocurrency CFDs.

Trading 24/7

Crypto never sleeps. Major cryptocurrency markets accessible to you 24/7.

Why Admirals?

Multiple Trading Platforms

Trade using the popular MT4/MT5 or the unique Admirals Platform.

Access global markets

More than 4000+ instruments to trade in the Equity CFDs, Commodity CFDs and Currency CFDs.

20+ years in service

Award-winning broker.

Support in a wide range of languages.

Read more about Cryptocurrency

Cryptocurrency, often referred to simply as crypto, is typically a decentralised digital currency, which is secured by cryptography and based on blockchain technology. Unlike paper currencies, cryptocurrency does not exist in physical form, is not controlled by governments or any other central authority, and is issued by the private sector.

However, although not being directly controlled by a central authority, as its popularity increases, cryptocurrency is facing greater scrutiny and increased regulation from governments around the world.

Despite being relatively unheard of ten years ago, cryptocurrency has attracted significant global attention in recent years and even became legal tender in El Salvador in September 2021.

Crypto CFD trading involves speculating on cryptocurrency price movements without owning the underlying assets such as for example, Bitcoin, Ethereum, XRP, Litecoin etc.

Traders use Contracts for Difference (CFDs) to be able to take advantage of price changes, either rising or falling. While it offers leverage and the potential for gains, it also carries high risk. Market volatility, leverage, and the possibility of rapid losses make it particularly dangerous for inexperienced traders.

For those interested in trading crypto, the most intuitive thing may seem to simply buy and hold crypto, potentially selling it for a profit in the future if its value rises. However, by trading crypto in this manner, you can only potentially profit from rising prices. Furthermore, when buying crypto coins, you need to factor in crypto exchange fees.

However, trading crypto CFDs allows traders to attempt to profit from both rising and falling cryptocurrency prices which, given the historic volatility of crypto, provides many more trading opportunities. Nevertheless, it is important to bear in mind that, as well as increased trading opportunities, volatility brings a significant increase in risk.

By trading crypto CFDs, traders never actually own the underlying cryptocurrency and trades are usually executed instantaneously at the market value. Moreover, trading crypto using CFDs means traders benefit from the use of leverage, which can magnify potential profits. However, leverage must be used with caution, as it will also magnify losses when the market moves against you.

Many brokers don’t charge commission fees for trading crypto CFDs. However, traders will need to consider the spread and, if they want to maintain a position over night, they will be charged swap fees.

Traders also need to consider and be aware of potential tax on cryptocurrency.

As with the majority of assets, any profits made from trading crypto may be liable to capital gains tax, regardless of whether you trade using crypto CFDs or buy cryptocurrency and then sell it for a profit - although some tax authorities may allow you to deduct your losses from capital gains.

In order to ensure you understand and comply correctly with tax on cryptocurrency, it is important that you check the specific requirements with your local tax authority.

Cryptocurrency prices have a history of being particularly volatile in comparison with other assets. When it comes to trading, volatility is very much a double-edged sword.

The presence of increased volatility provides traders with many more opportunities to potentially profit from going both long and short, with some traders thriving in volatile market conditions.

However, increased volatility also significantly increases the risks associated with trading. Therefore, for those trading crypto, it is especially important to develop and implement a sound risk management strategy.