DAX40 CFD - unul dintre cele mai populare instrumente

This is the CFD on the German benchmark index. The German stock market and the DAX-Index belong to the most interesting and most traded values worldwide. Nearly every german newspaper showcases how important the DAX is. Reports about the DAX are everywhere.

One of the most popular trading instruments at Admirals UK are the DAX40 CFDs, our Contracts for Differences (CFDs) for the German main index. CFDs allow the trader to generate profit from rising and falling prices.

Our trading conditions for DAX40 lead the German-speaking world. DAX40 is our bestseller because we offer:

- typical spread: 1 point

- Now with mini lots for all indexes, i.e. you can trade starting with 0,1 CFD

- no commission/order fees, you only pay the spread

- no requotes, guaranteed by our market execution

- no minimum interval between the order and stop loss/take profit

- attractive margin requirements: 0.5% (leverage at 1:200)

- generate profit from both rising and falling prices, go long or short

- open end means no maximum interval for contracts, so you can theoretically keep CFD contracts as open positions indefinitely

- the trading session for DAX40 is analogue to the Eurex, from 8AM to 10PM in Germany

- unlike options or warrants, volatility practically does not matter - price formation and movement is transparent plus comprehensible.

Se aplică și celelalte avantaje ale clienților noștri Admirals UK, inclusiv:

- no reserve liability because our Negative Balance Protection Policy helps prevent negative account balance

- real-time charts and quotes cost free via the MetaTrader 4 trading software

- quick, comfortable and elegant 1-click-trading within fractions of a second

- renowned regulation under the Financial Conduct Authority (FCA) - the world’s strictest regulation for Forex and CFD brokers

- direct real-time news in the MT4 software, windows connect

- opțiuni de depunere, respectiv retragere fără costuri, carduri de plată, Skrill și transfer SOFORT

- hedging and all trading styles (e.g. scalping) are permitted together with all expert advisors (EAs) - no barriers, no limits.

You can make profit out of market movement in both directions when trading CFDs on the DAX, because CFDs allow investing in falling and rising prices. In trading jargon, this is called going short and going long respectively. For instance, if you buy a DAX CFD at a price of 9,000 points and the DAX then rises up to 9,010, you can realize a profit of 10 EUR by closing your position.

Two example trades

- 1 DAX40 CFD, LONG

-

Opened at9,000 puncte

-

Order size9,000 EUR

-

Margin 0.5%9,000 EUR x 0.5% = 45 EUR (margin requirement)

-

-

Example 1: DAX risesExample 2: DAX falls

-

Closed at9.050 puncteClosed at8.950 puncte

-

Profit50 EURLoss- 50 EUR

The two example trades illustrate how leveraged trading equally offers great potential profit with very little investment and great potential loss. The market can turn around quickly and run against your position, like example trade 2. Here, your hypothetical loss is even higher than your invested margin.

Marja reprezintă suma de bani pe care trebuie să o investești pentru a deschide o poziție. Dacă piața se mișcă puternic împotriva poziției tale, soldul contului Admirals UK acționează deja ca o plasă de siguranță suplimentară - un tampon de capital. Acest capital poate fi utilizat pentru acoperirea pozițiilor pe pierdere. Cu toate acestea, ar trebui să utilizezi în continuare instrumentele esențiale de atenuare a pierderilor, cum ar fi ordinele de tipul Stop Loss.

At Admirals UK, you decide whether one point in DAX40 is worth 1 or 50 EUR - depending on the amount of contracts you are trading. This keeps you clear on how much worth your positions hold. If the DAX moves 10 points, you win or lose 10, 20 or 50 EUR respectively. This is a simple, comprehensible and transparent concept that shows financial products aren`t always complicated.

But things get more complex when dealing with warrants and options. For example, if you open a position in DAX-future, movement of a single point is worth at least 25 EUR. Then it`s often not obvious what a movement of 1 point even amounts to, since other factors like fair value and volatility have significant impact too. Added to this, order fees and commissions can further diminish your profits.

The margin and DAX40 CFD

There are countless options to trade the German main index with leverage, including several instruments for the private trader. One of the most popular options are the so-called DAX futures, which you can trade at the future market Eurex for example. Target spread for futures is 0.5 points and depending on the current market situation, even lower for our DAX40 CFDs. However, since these futures are traded at the official stock market, additional commissions per order should be considered. These can differ between brokers, but in general, it`s safe to say that costs end up being considerably higher than for our CFDs.

The margin requirements are even more important for many private traders. The high margin requirements of futures, have earned them a reputation for being the market’s most expensive option. This makes them best suited for institutional traders rather than private ones. With futures, margin requirements differ from broker to broker - sometimes 4 or 5 digit sums per future contract. These figures are simply too high for the average private trader, so CFDs are an attractive alternative.

The calculation for DAX40 CFD is fairly simple, since Admirals uses a fix leverage of 1:200. Simply divide the index`s current point value by 200 and you receive the required margin in EURO. For example, if DAX40 is at 9,000 points, then the necessary margin for one contract is 45 EUR (9,000 / 200 = 45)

CFDs make small-size engagements interesting. Whether you want to trade 2 or 10 contracts, risk plus reward are determined by your account balance and trading style.

DAX40 CFD spread

You are always looking at two different prices when trading Forex and CFD - sell (or ask) and buy (or bid). For a long order (i.e. betting on prices to rise), you can open a position at the buy price and close it for the sell price later. The difference between the two is the spread.

You need to generate more yield than the value of this spread before you break even and really make profit. This naturally means that the smaller the spread, the easier you can produce profit.

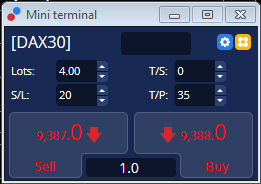

MiniTerminal is the advanced MT4 interface

In case of DAX40 trading, the spread is typically fixed at 1 point (or 1 EURO), which means you can trade with a spread of 1 point before official hours (8AM to 9AM).

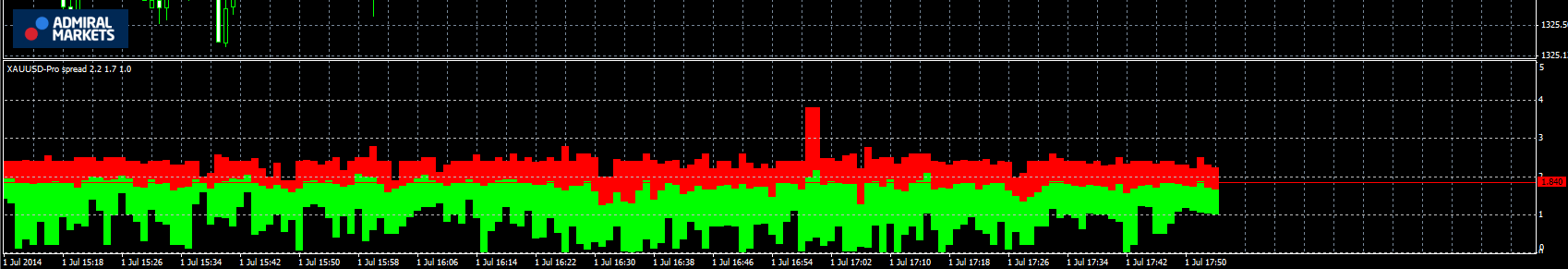

Indicator al spread-ului în add-on-ul MT4 Ediția Supremă oferită de Admirals

În general, Admirals nu percepe comisioane sau taxe pentru CFD-urile pe indici. În cazul tranzacțiilor intraday (pozițiile închise în aceeași zi în care au fost deschise), spread-ul este singurul cost de tranzacționare existent.

If you keep your DAX40 positions open overnight, a SWAP fee incurs, no matter what broker you`re using. This is a small fee per contract. You can learn more about this on our Contract details page.

DAX40 CFD price quote

There is not just one single DAX. When a trader compares different CFD brokers or prices from Xetra (with future-DAX), there will always be minor differences in the price chart.

Every execution venue has an individual price quotation. Xetra prices will always differ from future prices - even big investment banks provide slightly different numbers. Additionally, there are different trading sessions. For example, the Xetra-system is active from 9AM to 5:30PM, while the future stock market is active from 8AM to 10PM. Futures have a different lifespan, as they slowly lose their fair value with every passing day. But since the DAX40 CFDs provided by Admirals are not time restricted and can be held open end, there is not much deviation when compared to futures.

Our DAX40 CFDs are priced with the so-called cash index, as opposed to the future index. Cash markets are a significant reference for this. Admirals’ liquidity providers constantly give bid/ask prices and tradable liquidity. They orientate on reference markets to maintain a fair, transparent and comprehensible price quotation. In practice, these deviations are minimal and rarely exceed one to three points.